Source : https://www.brookings.edu

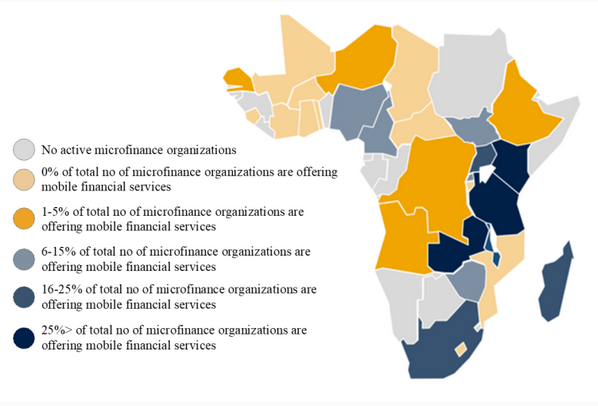

In an attempt to deepen financial inclusion, microfinance organizations are introducing digital solutions to serve low-income households and small- and medium-sized enterprises. Mobile financial services and fintech solutions are particularly promising in Africa where financial inclusion is only 43 percent, whereas mobile phone penetration is almost 90 percent. Such solutions show promise: In Kenya, for example, mobile financial services—specifically mobile money—contributed to increasing financial inclusion from 26.7 percent to 82.9 percent between 2006 and 2019.

Microfinance organizations have two goals: One is to increase financial inclusion, the other to be financially profitable—or at least financially sustainable. Balancing those goals is not easy, as leadership must choose between prioritizing social impact versus financial performance, and must consider changes that come with time, investments, environmental fluctuations, innovations, and the like. Thus, as is common when pursuing dual, often conflicting aims, optimizing both is hard.

Still, the rewards are worth it, and innovations are making this goal more achievable every day. Indeed, mobile money, fintech services, and online banking have the potential to transform the microfinance industry in Africa, given their enabling capabilities to increase both financial performance and social impact.