Through its Savvy platform, Trellis empowers fintech partners to deepen consumer engagement, generate new streams of revenue, and promote smarter insurance decisions

Trellis, the company leading a fundamental shift in how businesses and consumers engage with insurance, today announced significant new capabilities to its recommendation platform, Savvy, making it the industry’s first end-to-end API solution to enable consumers to instantly compare and purchase car insurance within a partner’s app or website. The updated Savvy continues to allow consumers to compare their existing policy to prospective alternatives in a transparent, side-by-side manner using just their insurance login, and now adds the unprecedented ability to purchase a better plan, and even cancel the old one – all on the same streamlined platform.

Competition is heating up among fintech apps and neobanks – such as Square Cash, PayPal, and Affirm – all vying for the coveted position as their users’ financial “superapp” of choice. Fintech leaders like Albert and Truebill have led the way in integrating insurance as part of their holistic suite of financial offerings. Considering 80% of adults in the U.S. drive a car, this unlocks tremendous value for the great majority of their user base and creates new opportunities for engagement. In addition, the $250 billion U.S. market for car insurance spends over $40 billion on sales and marketing – primarily through lucrative sales commissions that Savvy’s turnkey platform helps partners access and generate.

Key benefits include:

Creating a Safer, Simpler Insurance Shopping Experience For Consumers

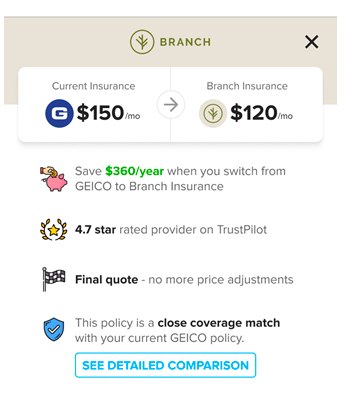

Consumers used to give up on saving money on car insurance because of the level of effort and the risk of making a mistake. Now, with just the password to their existing insurance, consumers can use Savvy to instantly access final insurance quotes (not just rate estimates) that are guaranteed to match or beat every line of coverage already held. Integrated checkout makes switching as simple as entering a credit card number – Savvy takes care of the rest. If help is needed, customers get free access to a specially-trained team of nationally-licensed insurance advisors – conveniently available over SMS, phone, and email.

Empowering Consumer Businesses to Understand and Serve Their Customers

Savvy enables all kinds of businesses – especially consumer fintech applications – to deepen the financial data and insight they have about their users, and to serve them more broadly. Partners embed Savvy in order to deliver a personalized insurance comparison and optimization experience, which delights end consumers and generates significant new revenue for growth.

Setting a New Standard for Privacy and Security in Insurance

Trellis password protects insurance data to provide a much-needed layer of security for highly sensitive personal information. This might sound like an obvious necessity, but it’s not a common practice within insurance. By allowing policyholders to securely access and share information, Trellis not only protects insurers from data breaches, but also enables the integration of insurance into the broader world of personal finance.

“Buying insurance is a complicated process that currently lacks transparency – consumers are tasked with loads of paperwork, fine print, and policy options they may not fully understand or know how to compare. As a result, many are stuck with policies that are too expensive, and not tailored to their unique needs,” said Daniel Demetri, Trellis founder and CEO. “We developed Savvy to help consumers better evaluate their options and to ensure they maximize the value and satisfaction they receive. With the updated Savvy platform, we have defined a new gold standard for a streamlined, embedded, end-to-end consumer journey.”

The new Savvy is now available to select consumers across the Midwest and South through an initial partnership with Branch, a full-stack insurance company that uses data and technology to make insurance easier to buy and less expensive. In the coming months, Trellis plans to expand this partnership nationwide and launch similar partnerships with other leading insurance providers.

“At Branch, we’re on a mission to make insurance quicker, easier, and more convenient. Demystifying the choices a consumer has to make around their coverage is a key component of doing that well,” said Steve Reffitt, Head of Agency at Branch. “With Savvy, Trellis helps close the gap with its incredible technology, giving consumers the power to easily compare apples to apples and ultimately find the best price for their policy.”

Not only does the launch of Savvy’s new functionality represent a major innovation in the industry, but it’s also a critical proofpoint of Trellis’ recent momentum. Over the past year, Trellis has doubled its partnerships and currently counts 4 of the 5 top digital-only banks as partners. The company has seen significant user growth – with the number of new monthly users nearly tripling over the past 6 months. In total, more than 6 million users have visited Savvy, and over 650,000 user insurance accounts have been securely connected to Trellis.

Looking forward, this launch lays the foundation for continued innovation within insurtech, as Trellis works to onboard more insurance companies onto its platform, and create new pathways for consumers, businesses, and insurers to better navigate the world of insurance. Trellis has invented a way to securely access and share insurance information that will ultimately unlock unprecedented value for all stakeholders.