Euroclear has announced its investment in Fnality, formerly known as the Utility Settlement Coin (USC), an international consortium of global banks and financial market infrastructures focused on building regulated payment systems to support the adoption of tokenised assets and marketplaces.

As Euroclear develops its future Distributed Ledger Technology (DLT) capabilities, it is partnering with Fnality to provide an innovative solution for the settlement of digital securities against digital cash on DLT. The solution aims to increase speed and efficiency for a range of post-trade operations from primary market issuance to secondary market and collateral trades, and servicing interest payments.

“We are pleased to be working with Fnality and our clients in shaping a cutting-edge solution on wholesale digital cash and digital securities settlement for the benefit of the whole industry,” Lieve Mostrey, CEO Euroclear Group.

This investment follows the recent Euroclear-led Central Bank Digital Currency (CBDC) experiment to settle French government bonds on DLT, commissioned by the Banque de France. The experiment with the French market confirmed that blockchain technology is suitable to manage post-trade market operations in CBDC.

Meanwhile, Fnality uses a private version of the Ethereum blockchain. It’s main blockchain technology partner is Adhara, and UBS and Clearmatics initially developed the concept.

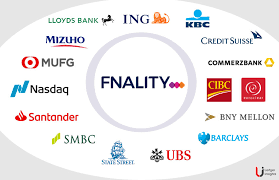

Fnality is owned by 16 financial institutions, including Nasdaq, BNY Mellon, State Street, and UBS. Euroclear operates Central Securities Depositories (CSDs) across Europe, including Belgium, Finland, France, Ireland, the Netherlands, Sweden, and the United Kingdom.

Euroclear group is the financial industry’s trusted provider of post trade services. Euroclear provides settlement and custody of domestic and cross-border securities for bonds, equities and derivatives to investment funds.

Source : Euroclear

Image source : ledger insights