Money is a vital tool in our modern society. From the early days of barter, where physical items were used to facilitate the exchange, to the modern world, where paper notes and coins serve as legal tender, society’s need to find some form of instrument for exchanging goods and services remains vital.

Advancements in modern digital technologies are giving rise to digital payments; with an emergence of privately issued digital currencies, including cryptocurrency. These developments have given rise to the need for central banks to consider issuing their own digital currency, known as a Central Bank Digital Currency (CBDC). These can be described as a digital legal tender issued by a central bank, pegged to the value of the issuing country’s fiat currency and regulated as part of its monetary and fiscal system.

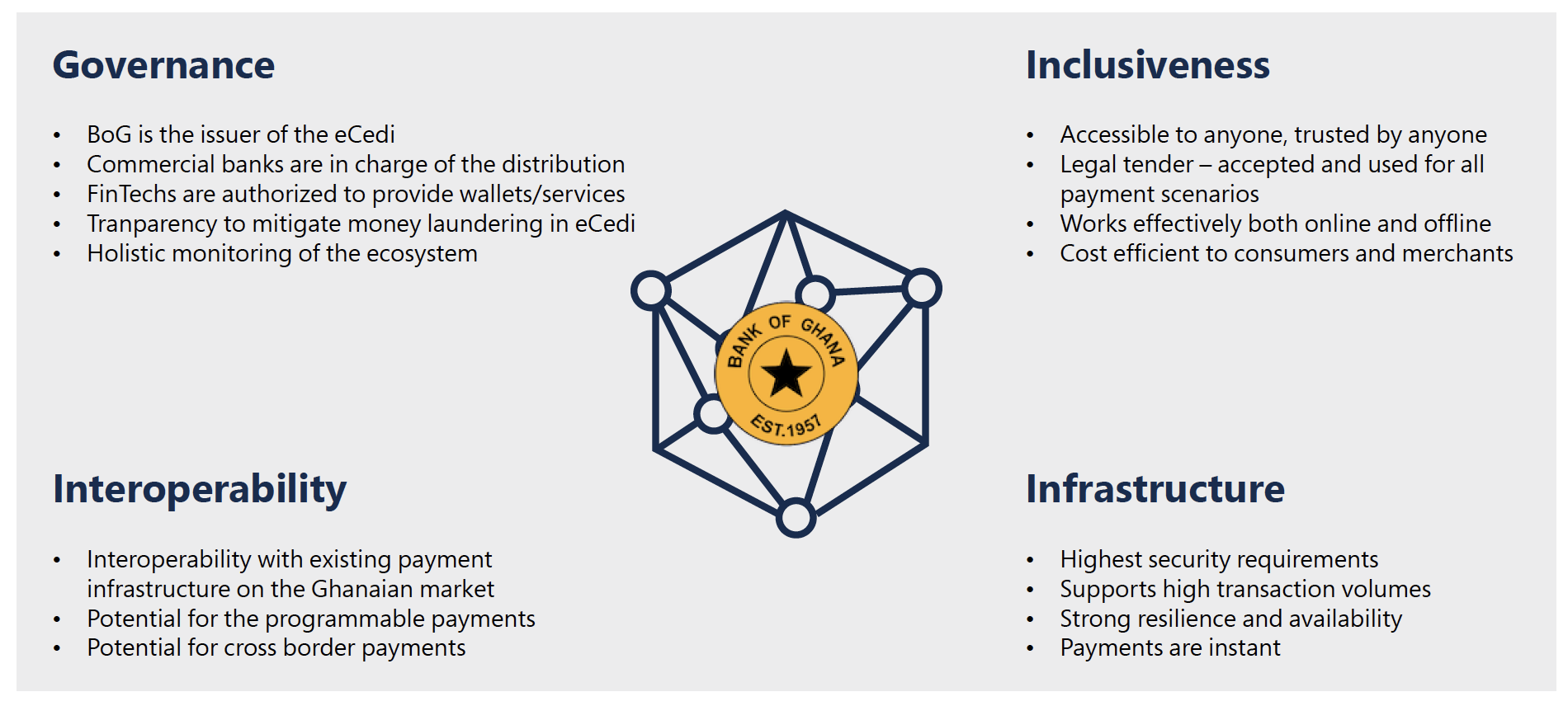

The Bank of Ghana announced its plan to launch a digital currency to be known as eCedi in 2019, and in 2022 it issued a 32-page design document that provides information on the eCedi vision, key motivations, expected benefits, and design principles, including governance and accessibility, interoperability, requisite infrastructure and security.

The e-Cedi is designed as a digital replica of the Ghana cedi notes and coins. It is crafted as a retail token-based CBDC stored in a digital wallet, convertible to Ghana cedis in the form of cash or deposit money on a 1:1 ratio. This is to say that the owner of e-Cedis can redeem them for physical cedis and use it for a variety of payments.

The eCedi comes with various advantages; prominent among them is the potential for more efficient and secured payments, lower transaction costs and faster processing times. Also, it can save the central bank money, as it by-passes the high price of printing notes and minting coins abroad. It also enables citizens to consume central bank digital products directly, increasing the speed of settlement especially when it comes to real-time payments.

With the central bank backing, the eCedi holds a stable value compared to cryptocurrency, which is characterised by high volatile pricing. One of the economic challenges that eCedi can help solve, is the considerable number of unbanked and underbanked persons in Ghana, as it can serve as a powerful tool for financial inclusion by increasing access to digital payments and creating lower or zero-cost bank-type accounts.

There are several disadvantages associated with the eCedi. Cash offers a high level of privacy and anonymity since there is no means of monitoring cash transactions; however, with eCedi it will be possible to track and trace each transaction. Given that the central bank is a government entity, some people are just not enthused about the idea that a state entity can access information about their spending patterns.

Although there are a number of safeguarding mechanisms suggested to deal with these privacy concerns, some believe they do not go far enough and the risk remains and that the central bank of Ghana must work toward assuring better anonymity, even better than what commercial banks or other digital payment providers are currently offering.

Further, there is a lack of clarity on whether the eCedi will be accepted across borders as a means of payment, especially in international trade and transactions. One of the main reasons for the issuance of eCedi is its potential to serve as an alternative to cryptocurrency; nevertheless, it does not have the same characteristics as cryptocurrency, especially its lack of central control and its distributive nature.

Another challenge with eCedi is that it may position the Bank of Ghana as a direct competitor to digital payment providers, especially mobile money, meaning possible loss of income for players in the fintech ecosystem.

Also, for the banking sector, if consumers increase their holding in CBDC, it may provide direct competition to in-person bank deposits.

Lastly, there is no guarantee that consumers will be interested in accepting eCedi since it does not offer any perceived advantages over existing digital payments, meaning it may not attain widespread adoption.

In conclusion, eCedi offers many advantages and innovations needed to support our fast-evolving digital payments ecosystem; in the same breath, it is confronted with many challenges. By deciding to pilot the eCedi, the central bank of Ghana is putting itself in a position of being a pioneer in digital currency, meaning it can learn the ropes over time about how to manage CBDC effectively, evolve standards and mechanisms to sustain its uptake.

Kwami Ahiabenu, II (Ph.D.) is a Technology Innovations Consultant

Email : kwami AT mangokope.com

First published by Daily Graphic