When Raj took out a loan for $110 (£87) in March, he thought it would swiftly solve his financial problems, instead it has made his life much, much worse.

The Pune-based man had been lured into one of India’s many digital loan scams.

Like many, Raj (not his real name), was attracted by the quick and easy loan approval process. All he had to do was download an app to his phone and supply a copy of his identity card to qualify.

He quickly received some money – but only half of the amount he requested. Just three days later the company started demanding he pay back three times the amount they loaned him.

His debts spiralled as he took loans out from other finance apps to pay off the first. Eventually, Raj owed more than $6,000 (£4083), spread across 33 different apps.

Many of the people running those apps began threatening him over repayments but he was too scared to go to the police.

The people running the apps gained access to all the contacts on his phone and his pictures, and have threated to send nude pictures of his wife to everyone on his phone.

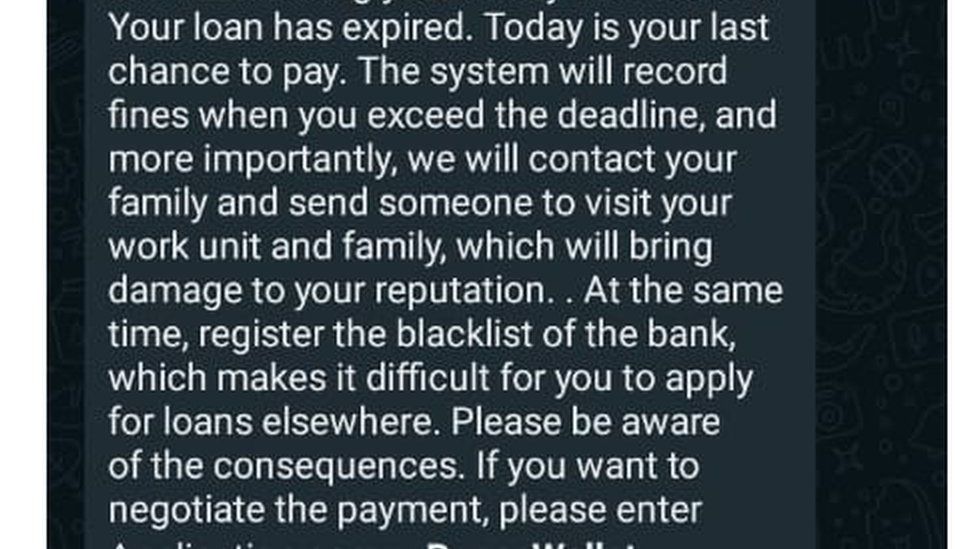

Image source, Raj Image caption, Just one of the threatening messages received by Raj

Image source, Raj Image caption, Just one of the threatening messages received by RajTo pay off the scammers he has sold all of his wife’s jewellery, but says he is still frightened.

“I don’t think they will let me go. I am scared for my life. I get threating calls and messages everyday,” Raj says.In India, this type of mobile phone scamming has become all too common. Between 1 January 2020 and 31 March, 2021, a study by the Reserve Bank of India (RBI) identified 600 illegal lending apps.During that period, Maharashtra state recorded the highest number of complaints relating to lending apps, with 572 reported to the RBI.

“These apps promise hassle-free loans, quick money, and people are lured into them, not realising that their phones get hacked, their data gets stolen and their privacy is comprised,” says Mr Yashasvi Yadav, special inspector general of police, Maharashtra Cyber Department.

“I would say it’s a scam which is spreading because so many people in India are not eligible for [legitimate bank] loans,” he adds.

Often the apps are run via servers in China, but the scammers themselves are usually located in India, says Inspector Yadav.

He says many scammers have been caught by tracking their bank accounts and phone numbers.

But one scammer the BBC spoke to said it was relatively simple to evade detection by the Indian authorities.

“The founders of apps, or people like us who work for them, are very difficult to trace as we use all fake papers to get a mobile number.

“We operate from all across India. Most of us don’t have a fixed location to work from. All I need is laptop and a phone connection. One operator like me has more then 10 numbers to use for threatening the customer.”

This particular scammer told us that they are trained to find “gullible and needy” people, who are then loaned just half of what they ask for. Then, as in the case of Raj, the scammer will demand that three times that amount is paid back.

If the victim fails to pay, more pressure is quickly applied.

“The first step is to harass. Then threaten. Then the actual game starts of blackmailing the person, as we have loanees’ phone details,” the scammer told us.

“Many don’t go to authorities out of shame and fear.”

The BBC has seen messages sent to victims – they include threats to tell family and work colleagues about the victim’s debts. But some are more brutal, with threats to make and distribute porn videos using the victim’s image.

The government has made some efforts to stamp out loan scam operators. In May last year, it urged Google to review the apps available from its Play app store.

Google is a key component, as almost all Indians with a smartphone will have its operating software, called Android, and use its app service, Play.

But when shut out from such services. the scammers move elsewhere, and use simple text messages to advertise.

Following its study of digital lending the RBI has asked the government to come up with new legislation to help curb illegal lending. It includes a central agency at the RBI which could verify apps.

The government is expected to respond within the coming weeks.

But any new rules will come in much too late for some.

According to his family, Sandeep Korgaonkar committed suicide on 4 May, due to the threats and harassment he was receiving from loan scammers.

According to his brother Dattatreya, Sandeep had not even taken out a loan, he had just downloaded the app.

Soon after that agents began calling Sandeep’s work colleagues telling them he had bad debts. They also manipulated his images to make nude photographs and forwarded them to 50 of his colleagues.

“The harassment did not stop, even after he filed a police complaint,” says Dattatreya.

“His life had become a living hell, he could not sleep or eat,” he adds.

The police are now investigating the case.