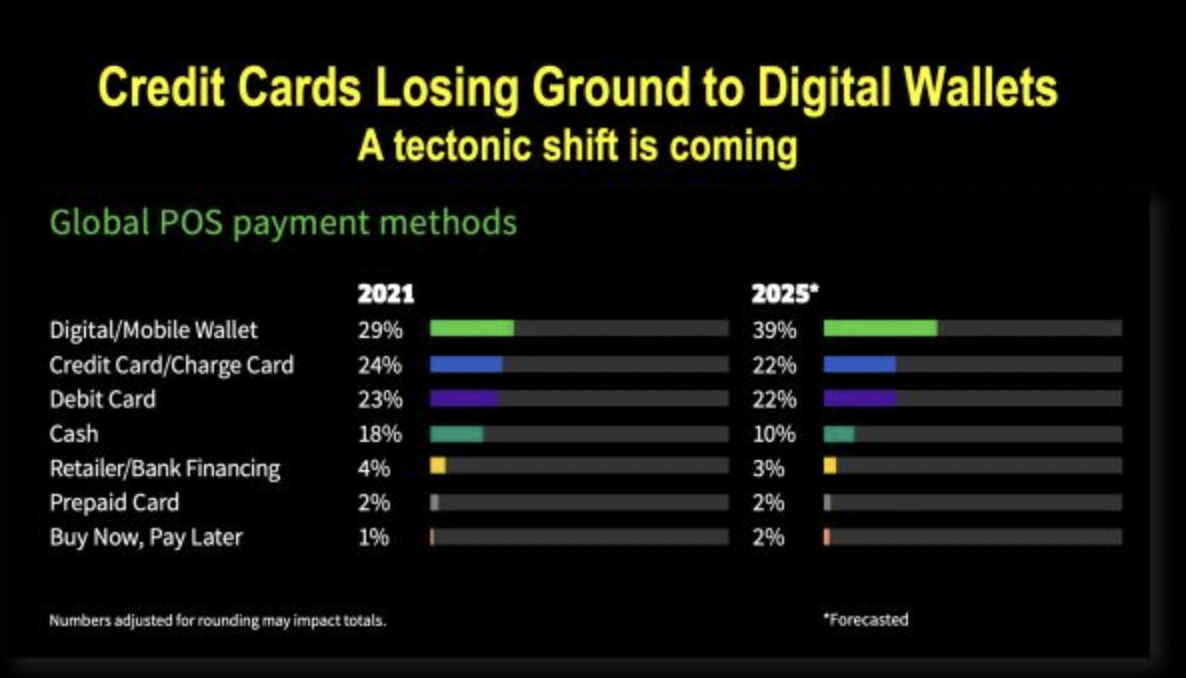

A major change in how we pay is coming that will hit credit card fees hard, card companies should brace for the impact, because the glory days of the card duopoly are over according to a new report by FIS Global Payment.“Mobile wallets’ share of global POS transactions jumped over 21% YoY in 2021 rising to 28.6% of global POS transaction value, or over US$13.3 trillion. APAC continues to lead the way in mobile wallet adoption with 44.1% of 2021 POS transaction value; mobile wallets are expected to outpace all other POS payment methods combined in APAC by 2023.”Globally mobile wallets are expected to rise to 38.6% share (over US$22.7 trillion) by 2025.

2021 was a big year for card companies, credit card use dropped! While debit card usage increased it’s clear that card usage is increasingly shifting to pass-through mobile wallets. This is a clear signal to card companies that “the livin’ is easy” is over for card companies.

The FIS Global Payments report makes it clear in no uncertain terms:“Credit card use dropped in 2021 and debit share increased; however, card usage is increasingly shifting to pass-through mobile wallets. Credit cards accounted for 23.9% of global POS transaction value in 2021 – over US$11.1 trillion – led by a 40.2% share in North America. Credit’s share is projected to decrease to 22.4% by 2025 when it will represent over US$13.2 trillion.”

There will be no tears for card companies who have maintained a lock on payments and fintech’s in the West despite a fee structure that comes from another era. Never forget that cards once used paper and card fees were at least in part based on human processing. Now in a digital era, paper charge slips and humans are long gone but the fees remain. An anachronism if there ever was one.