Just this Wednesday Sam Callahan appeared in Preston Pysh podcast. He did research around many CBDCs projects popping up here and there and his conversation with Preston has many nuggets and conclusions I would agree with.

There is another just released paper by Bitcoin Policy Institute called “Why the U.S. Should Reject Central Bank Digital Currencies”, which is very boring to read. Moreover, when governments really stopped adopting bad or harmful technology if it has tremendously useful properties for them in the short term?

Even in USA “disintermediation” thesis against CBDC doesn’t look convincing if we consider long-term cartelization of the banking sector. JP Morgan might cut some costs managing client’s money while using CBDCs in global scale as McKinsey, PwC and BIS put in their numerous reports. Simply speaking, we might look for a different more reliable arguments about CBDC pros and cons, and use some common sense justification with early adoption data we have in particular cases.

Sam invited to consider some activities of the big international organizations such that WEF, IMF and BIS. I would add that BIS organized at least 7 projects, or more if we consider renaming and merging different projects together (see tracker here). BIS is uniquely positioned to return its middlemen status by guiding these projects taking place all over the world.

The Evil Plan

There is abundant material about how CBDC allow to implement negative key rates or enable invasive financial surveillance. While it is all true, the fun fact is that there is probably no need to impose negative rates anymore. On the other hand, capital controls and weaponization of finance may be even stronger with CBDC. But the most interesting part of using CBDC as a weapon is not in the enforcing sanctions globally.

CBDCs are uniquely positioned for enabling trade blocks and bilateral trade agreements: digital currencies will merely serve as common denominators in Central Bank’s databases for enabling constant flow of commodities. When in early 1930s gold standard fell these types of agreements allowed Hitler to re-build economy and prepare it for the new war.

To facilitate trade under this regime of direct controls, bilateral clearing agreements were concluded with a number of countries, especially in central Europe and South America, in which German purchases were credited against offset purchases by foreigners in German markets. By spring 1938, some 25 countries had agreed to such arrangements and more than half Germany’s foreign trade was carried on with them.

This quote is from Larry Neal’s “The Economics and Finance of Bilateral Clearing Agreements: Germany, 1934-8”. It gives approximate understanding of how Germany managed to use less gold in foreign trade. The same way as Hitler, Putin has intensified his efforts for building bilateral agreements with other countries since 2014, the year when sanctions were first broadly applied to his regime. Hitler’s Golddiskontbank even provided credit to the Soviet Union for industrial goods for which the Soviet’s first installment should have fallen in 1946. Stalin should have paid it with commodities.

May the Evil plan work? Probably yes in the short term and likely not in the long term because governments eventually approach trade blocks as war-time measure and use them for coordinated devaluation of their currencies. They simply do not stop printing money because it is always profitable for them.

The Ugly Reality

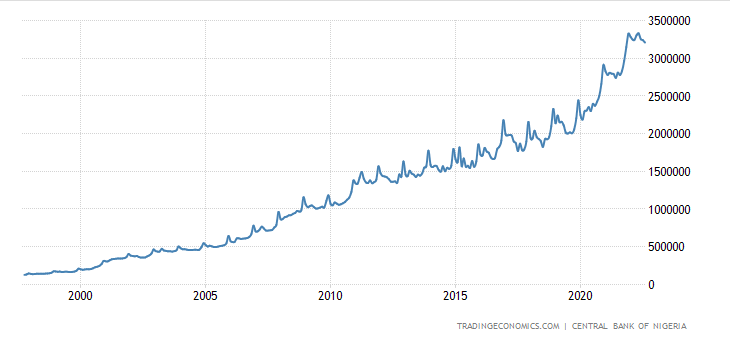

Here we came to eNaira case. This is Nigerian CBDC. For the first year CBDC attracted 700K users against 55M bank deposits. We can calculate approximate adoption rate 1.4%. For the reference IMF blames Bitcoin for 20% adoption in El Salvador in the first year and the comparison makes perfect sense since Bitcoin also Legal Tender.

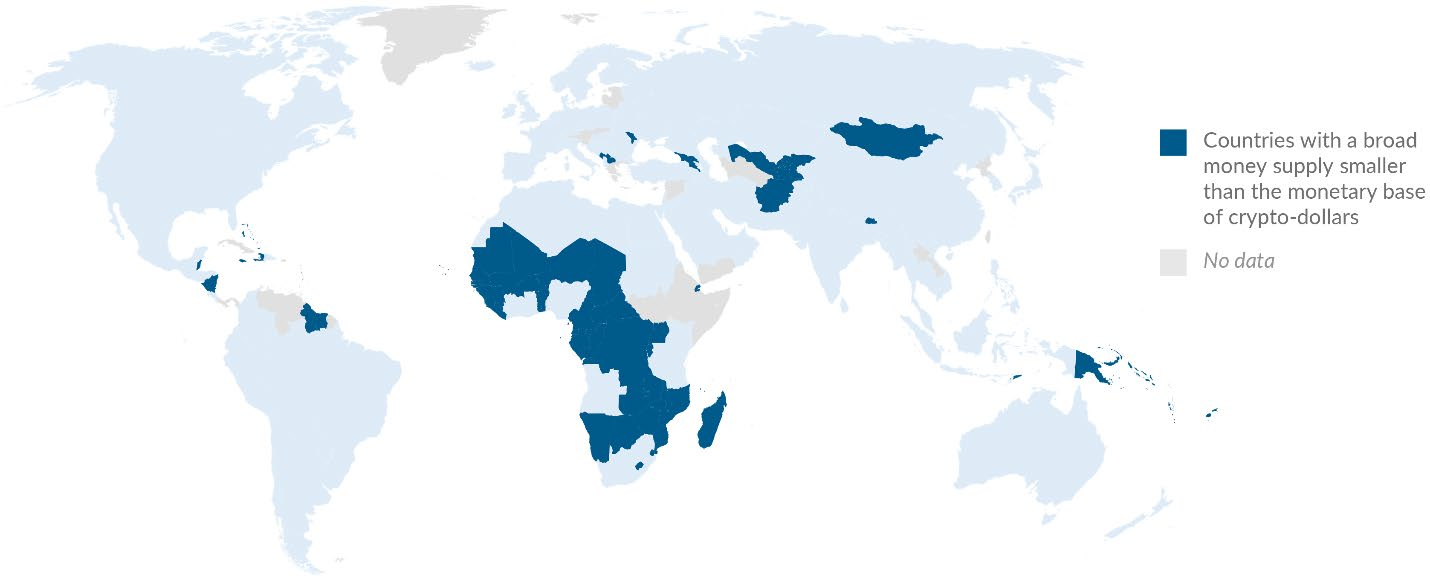

Nigeria tops Turkey, Argentina and UK in Chainanalysis crypto adoption rating. This is why Nigerian CB made usage of all other cryptocurrencies illegal. With CPI growth about 19% Nigeria becomes a candidate for bottom-up dollarization. And Castle Island Ventures did a good math about that: there are plenty of countries on the world map which may simply use USDT stablecoin for CBDC similarly to how El Salvador adopted Bitcoin.

National Stablecoins

Very idea of some of BIS projects were in implementing atomic swaps for facilitation of CBDCs exchanges on supposedly different (blockchain) platforms, some of them also included HTLC application tests. It suggests a new BIS role it may try to fulfill: be a “crypto” exchange hub for governments while having its cut in all cross-border payments. Despite that, BIS and IMF are together in very unfortunate position when Tether successfully works as large correspondent bank whose clients are capable to facilitate cross-border payments 24/7/365 and provide each other collateralized credit.

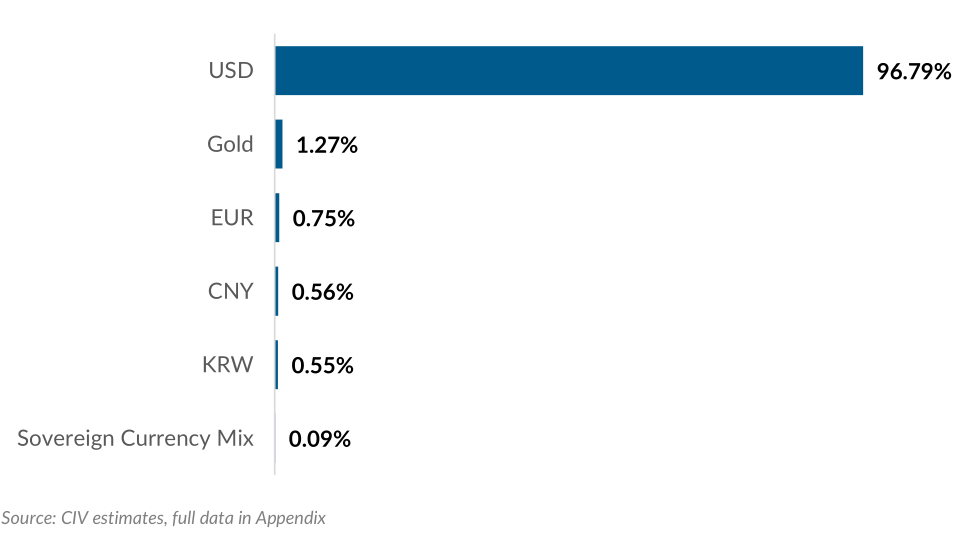

While dollar generally benefits from stablecoins as an idea, they may kill organizations like BIS which has already lived through one existential crisis in post Bretton-Woods system. There is another plot Castle Island Ventures has prepared in their research about cryptodollars. It clearly demonstrates power law in stablecoin volumes distribution. The plausible explanation for such distribution may be in the network effects and costs associated with managing liquidity. For sure, new laws and better legal framework for “tokenized” assets will increase value of the tail. However, it may also enable simultaneous expansion of dollar stablecoins as current global monetary standard. In this scenario proportion of CIV numbers shouldn’t really change.

Similarly to ICO tokens, national stablecoins will likely lead to re-introduction of the barter problem even if BIS will run an exchange for them and there is no good reason to assume that any other stablecoin is capable to undermine USD standard. However, let’s assume that strong capital controls and aggressive sanctioning of the transacting entities decreased usage of USD stablecoins and their issuance by private offshore banks. What new token trade partners may select to ensure minimal third-party risk and ethical money production?

source : https://telegra.ph/Why-CBDCs-May-Fail-09-28