These articles build on broader insights into how digital currency is accelerating the evolution of money, and how dollars and euros on public blockchains can catalyze significant improvements in payments, commerce and financial markets.

Now, we want to focus on what might be the single most important aspect of this transformation – financial inclusion. Simply stated, shifting dollars and commerce to the internet has the potential to boost access to financial services on a global scale in a way that’s never been possible.

Just as the internet long ago made it possible to send email, text and video across the world in seconds at very little cost to practically anyone, blockchains now enable money to travel with this same speed, scale, cost efficiency and reach.

Turning this financial inclusion potential into reality is core to Circle’s mission to raise global economic prosperity through the frictionless exchange of value. From a personal standpoint, it’s also what attracted us to work on blockchain in the first place, after careers at traditional corporations including News Corporation, Brightcove, Google, Meta and Paramount.

Let’s take a look at why this matters, and what we’re doing to make this infrastructure available globally.

Finance as a basic human right

At Circle, we think that access to finance is something that everyone, everywhere deserves. Yet financial friction and exclusion are still major hurdles for people all over the world, exacerbating global economic inequality and exposing people who can least afford it to the devastating effects of soaring inflation and slowing economic growth.

This situation is being compounded in real time by increasing geopolitical instability and growing macroeconomic uncertainty. Instead of flowing freely, financial and intellectual capital is grinding to a standstill in a growing number of places.

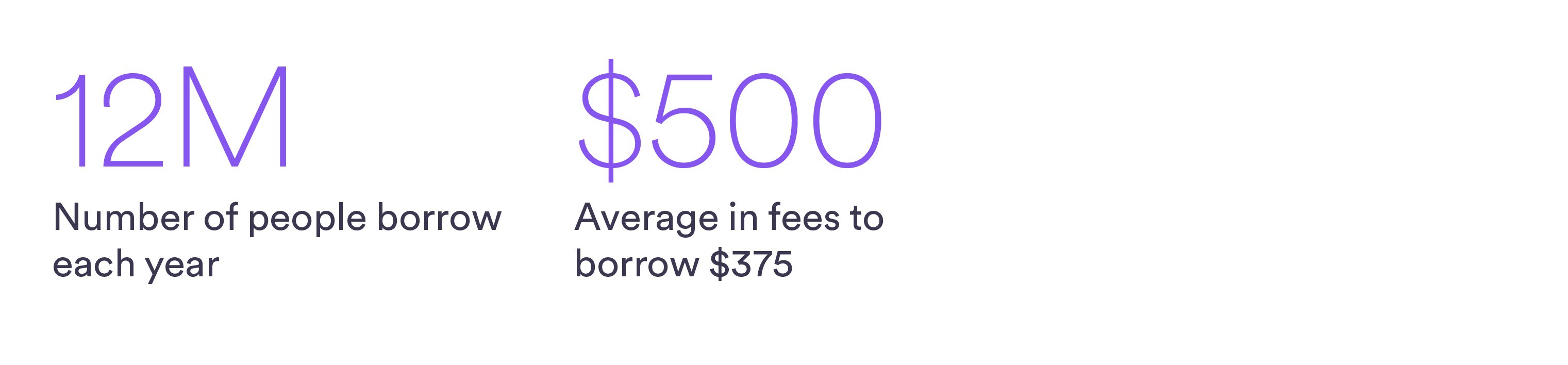

In the U.S., the world’s wealthiest country, there are still significant gaps in wealth and access. As an example, the Consumer Financial Protection Bureau (CFPB) estimates 12 million Americans take out payday loans each year.1 Most of these borrowers earn less than $30,000 per year and pay an average of more than $500 in fees to borrow $375 for 5 months.2

U.S. payday loan data

In many emerging markets, where economies are underdeveloped and traditional banking infrastructure is either not widely accessible or not present at all, the situation is even more dire. Increasingly, people and families in these countries are reliant on migrant workers remitting value home from developed economies.

In many emerging markets, where economies are underdeveloped and traditional banking infrastructure is either not widely accessible or not present at all, the situation is even more dire. Increasingly, people and families in these countries are reliant on migrant workers remitting value home from developed economies.

According to the United Nations, around 1 in 9 people globally is supported by funds sent home by migrant workers.3 By 2030, it’s estimated that remittance flows from migrant workers could top $5 trillion.4

Yet the World Bank reports that the average remittance cost is a staggering 6.3% of the amount sent,5 depriving some of the world’s neediest people of funds that are critical to obtaining daily necessities like food and healthcare.

Global remittance data

Financial access also takes on outsized importance in active conflict zones. According to the United Nations High Commissioner of Refugees (UNHCR), increasing humanitarian crises around the world have forcibly displaced 103 million people. For their 2023 outlook, the United Nations estimates that 339 million people worldwide are in need of humanitarian assistance. Only a year ago, it was 274 million people.6 Conflicts, the climate crisis and COVID are leading to growing hardship.

Financial access also takes on outsized importance in active conflict zones. According to the United Nations High Commissioner of Refugees (UNHCR), increasing humanitarian crises around the world have forcibly displaced 103 million people. For their 2023 outlook, the United Nations estimates that 339 million people worldwide are in need of humanitarian assistance. Only a year ago, it was 274 million people.6 Conflicts, the climate crisis and COVID are leading to growing hardship.

Taken together, these exorbitant costs and the rising number of people living in precarious circumstances are creating urgency around the need for new solutions. At Circle, our business is organized around using the internet and mobile devices to build a faster, better, fairer, more accessible way to move value around the world.

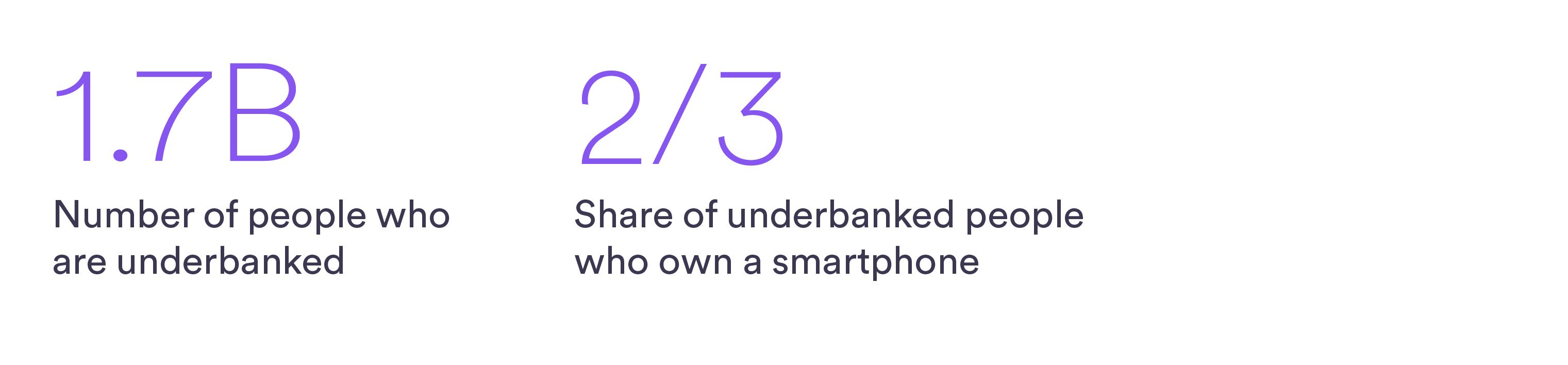

Although 1.7 billion globally are underbanked, two-thirds of these people own a smartphone.7 Smartphone-enabled digital currencies and public blockchains are perhaps uniquely positioned to shore up these gaps in the traditional financial system and make a lasting difference.

Our digital dollars and euros help extend the strength and stability of government-issued currencies to this new internet layer, where they are accessible for anyone, anywhere, with an internet connection.

The digital inclusion opportunity7

How Circle and USDC foster inclusion

How Circle and USDC foster inclusion

While we’re just getting started, here are some examples of how our approach is already bringing real-world payment utility to people and places that are underserved by the existing system.

Powering humanitarian aid and disaster relief

Collecting funds to support displaced people around the world is only half the battle. The other half is delivering it to people in need – no matter where they are. UNHCR and the UN Refugee Agency are turning to USDC, running on the Stellar blockchain to eliminate the need for those fleeing instability to carry cash, credit or debit cards. Aid recipients can access vital support via a Vibrant digital wallet and exchange their USDC for local currency at any MoneyGram location.

Bypassing a dictatorship to deliver aid to millions

In the height of the pandemic, front-line medical workers in Venezuela lacked access to critical medical supplies and equipment while suffering from the impacts of hyperinflation, international isolation and sanctions and economic collapse.

In collaboration with the Bolivarian Republic of Venezuela and U.S.-based fintech innovator Airtm, and in coordination with the U.S. government, Circle was able to put in place an aid disbursement pipeline that leveraged the power of USDC to bypass the controls imposed by Maduro over the domestic financial system, and put millions of dollars of funds into the hands of healthcare workers fighting for the health and safety of the people of Venezuela.

Simplifying peer-to-peer payments between U.S. and Mexico

For millions of individuals and families, the ability to send and receive money between the U.S. and Mexico is a lifeline. In 2020 alone, cross-border remittances increased 10% – reaching over $40B. Yet despite the vital importance of remittances, traditional methods of sending and receiving money are slow and expensive. Circle’s USDC and Bitso (the largest crypto exchange in Latin America) are making it easier, faster and more secure for Mexican residents to send and receive cross-border payments using blockchain technology.

Boosting digital financial literacy with Circle University

Circle University is a crypto education course available to academic institutions and partner organizations interested in catalyzing crypto literacy. Circle Impact partnered with select Historically Black Colleges & Universities (HBCUs) and other academic institutions as part of their Fall 2022 curriculum. A wider rollout to more organizations is in process now.

Bringing wider dollar access to Africa

Africa is rapidly proving how financial technology and digital infrastructure can scale and thrive to serve potentially billions of people. Since the launch of M-Pesa in 2007, people and businesses from across the continent have been at the forefront of using technology to move and manage value. Today, they are increasingly turning to digital currency and public blockchains to efficiently connect to global capital flows.

For the past 10 years, AZA Finance has helped businesses and institutions manage treasury, payments and FX into, throughout, and out of Africa. Many of AZA’s institutional clients are adopting dollar digital currencies like Circle’s USDC for wholesale commercial flows that can move across borders outside of traditional banking hours.

Expanding digital finance to African developers

The Mara Foundation, a non-profit organization dedicated to empowering youth, communities, marginalized populations, and problem solvers to build solutions that drive long-term positive social, economic and environmental change in Africa. Mara has partnered with Circle to help provide developers based in Africa with critical opportunities, tools and access needed to build Dapps and blockchain solutions. Through this first-of-its-kind strategic partnership, Circle and Mara aim to jointly increase awareness for USDC, champion blockchain adoption and train one million developers with the intent to positively impact Africa’s growing population of one billion people over the next five years.

These examples show not just that the infrastructure works, but that it is highly effective and that people globally want access to portable internet dollars.