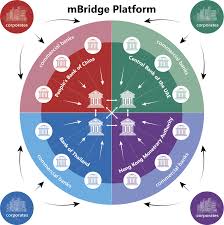

The initiative was founded by the central banks of Thailand, Hong Kong, China, and the United Arab Emirates. Participants include the IMF, World Bank, and 23 central banks from across the world, including the Bank of Namibia, Central Bank of Egypt, and the Reserve Bank of South Africa.

China-led global CBDC platform, mBridge, intends to introduce a minimum viable project in the middle of 2024 as the next step for the blockchain-based cross-border payments solution.

The initiative was founded by the central banks of Thailand, Hong Kong, China, and the United Arab Emirates, and it operates under the umbrella of the Hong Kong BIS Innovation Hub. Participants include International Monetary Fund, World Bank, and 23 central banks from across the world. Among these institutions are African institutions:

- Bank of Namibia

- South African Reserve Bank

- Central Bank of Egypt

Project mBridge experiments with a multiple-central bank digital currency (multi-CBDC) common platform for wholesale cross-border payments. It seeks to solve some of the key inefficiencies of cross-border payments, such as high costs, low speed and transparency, and operational complexities.

At the heart of the experimental platform developed for Project mBridge is a purpose-developed permissioned DLT called the mBridge ledger, or mBL, that supports instant peer-to-peer and atomic cross-border payments and FX transactions using wholesale CBDCs.

At the same time, the project aims to safeguard currency sovereignty and monetary and financial stability for each participating jurisdiction, guided by the principles of ‘do no harm,’ compliance and interoperability.

“While critical to the functioning of the international payments system, the global network of correspondent banks that facilitates international payments is hindered by high costs, low speed and transparency, and operational complexities due to duplicated processes and steps in the payment chain. Banks are also paring back their correspondent networks and services, leaving many participants (notably emerging market and developing economies) without sufficient or affordable access to the global financial system.”

– Bank for International Settlements

With Project mBridge, the number of steps can be significantly reduced by allowing direct, bilateral connectivity between the payee’s and payer’s local banks supported by interoperability with participants’ domestic payment systems.According to the participants, Multi-CBDC arrangements that directly connect the CBDCs of different jurisdictions in a single common technical infrastructure offer significant potential to improve the current system and allow cross-border payments to be immediate, cheap, and universally accessible with final settlement.

The platform – based on a blockchain called the mBridge Ledger – was built by central banks to support real-time, peer-to-peer, cross-border payments and foreign exchange transactions using CBDCs focusing on the use case of international trade.

How does the Project mBridge platform connect to external systems?

Interoperability with participants’ own systems is supported by APIs based on the global ISO 20022 messaging standard for financial information, to allow participants to easily connect and integrate into ISO 20022-compatible payment systems.

For commercial banks, cross-border payments and FX transactions are conducted through the interaction between their core banking systems and their mBridge backend.

For central banks, CBDC issuance and redemption operations are supported by the integration of mBridge into domestic payment systems, such as RTGS and CBDC, through each central bank’s mBridge backend. API connectivity to domestic payment systems means that a domestic CBDC system is not a precondition for joining the mBridge platform if adopted by central banks.

A next envisaged stage in this project is to see if the platform tested can evolve to become a minimum viable product, the Bank for International Settlements (BIS) said.